The Future of Megaprojects

The Future of Megaprojects

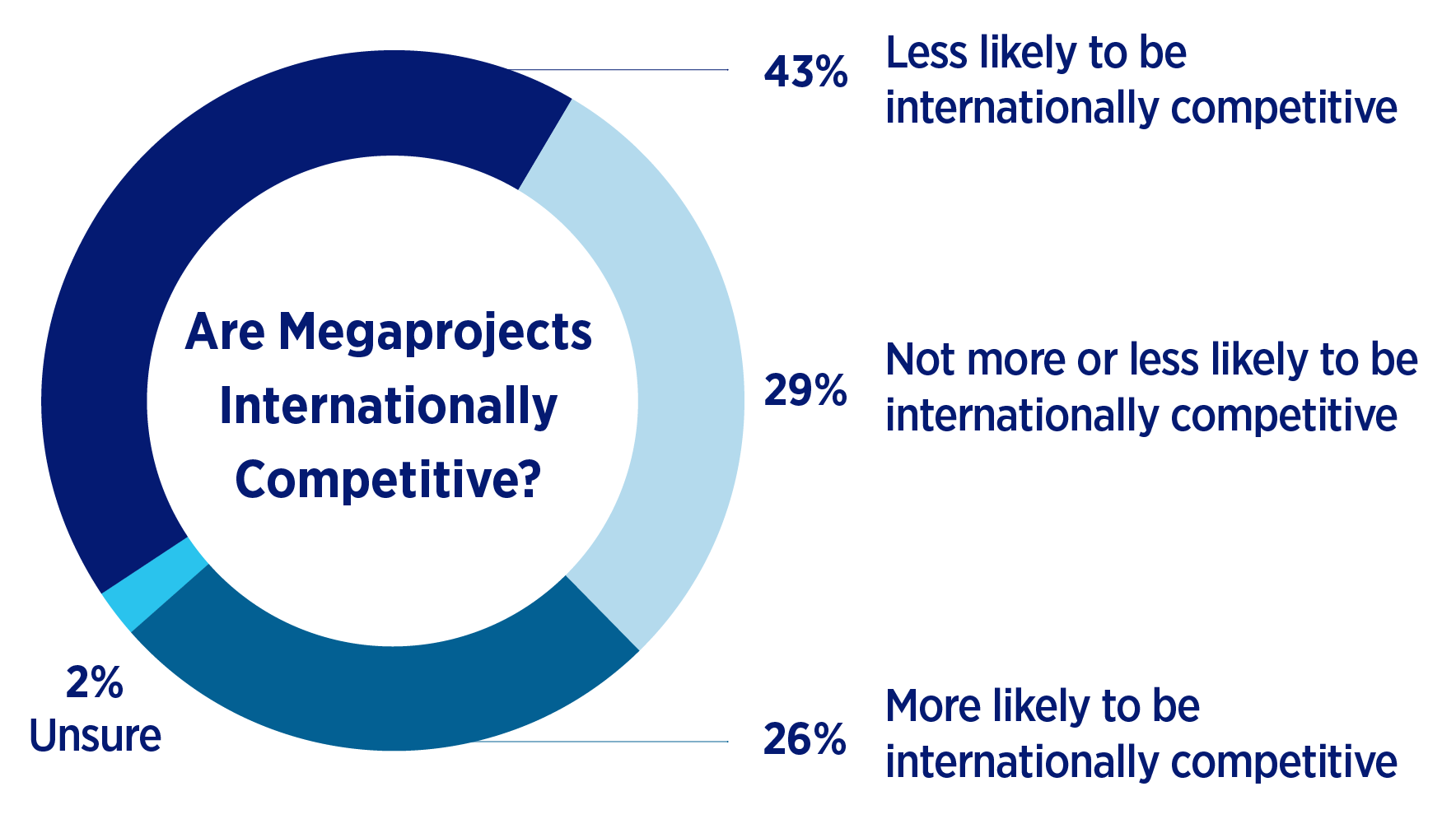

May 17, 2022New research from the Site Selectors Guild highlights site selection consultant perspectives on international corporate investments of more than $1 billion known as megaprojects.

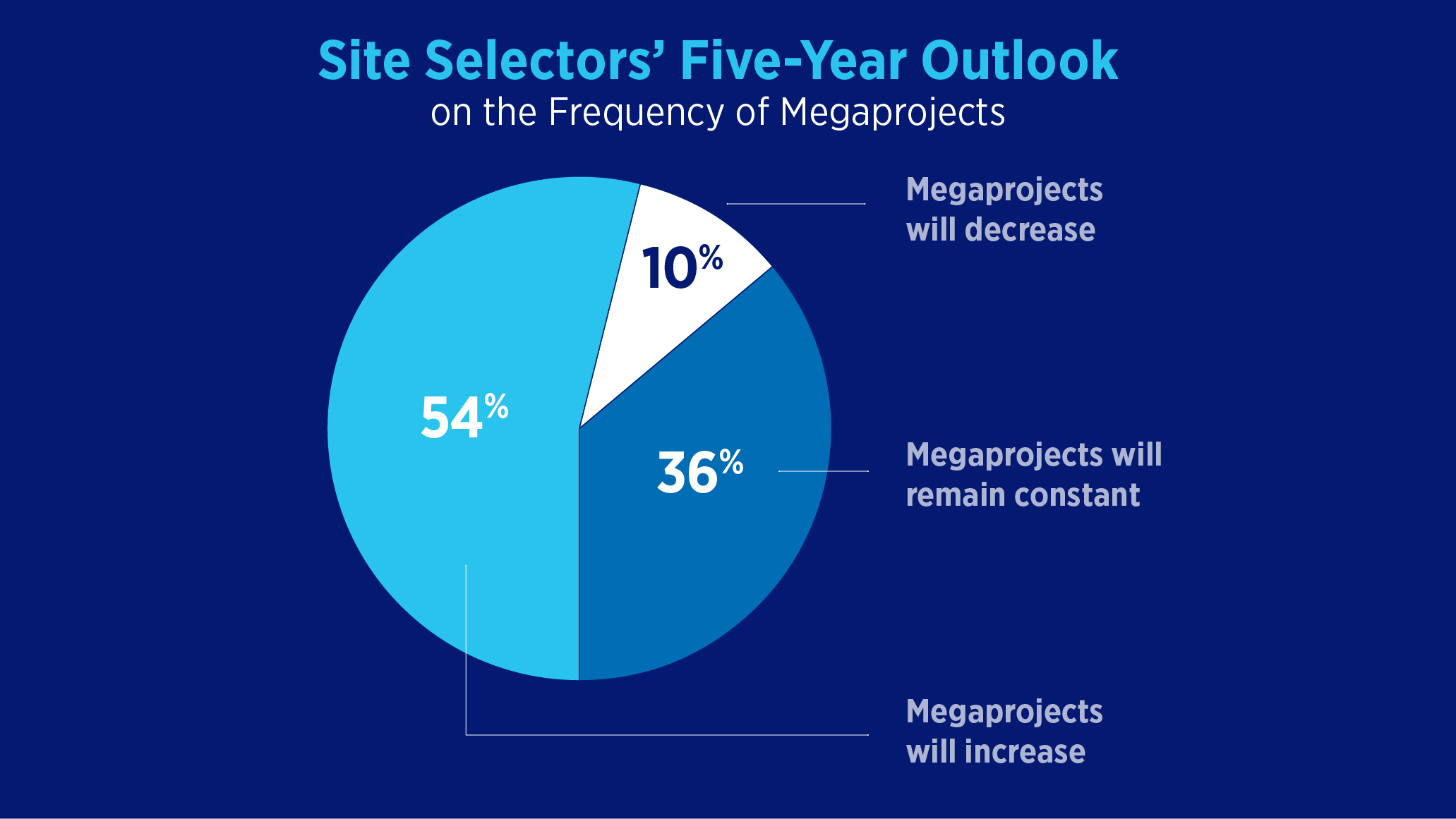

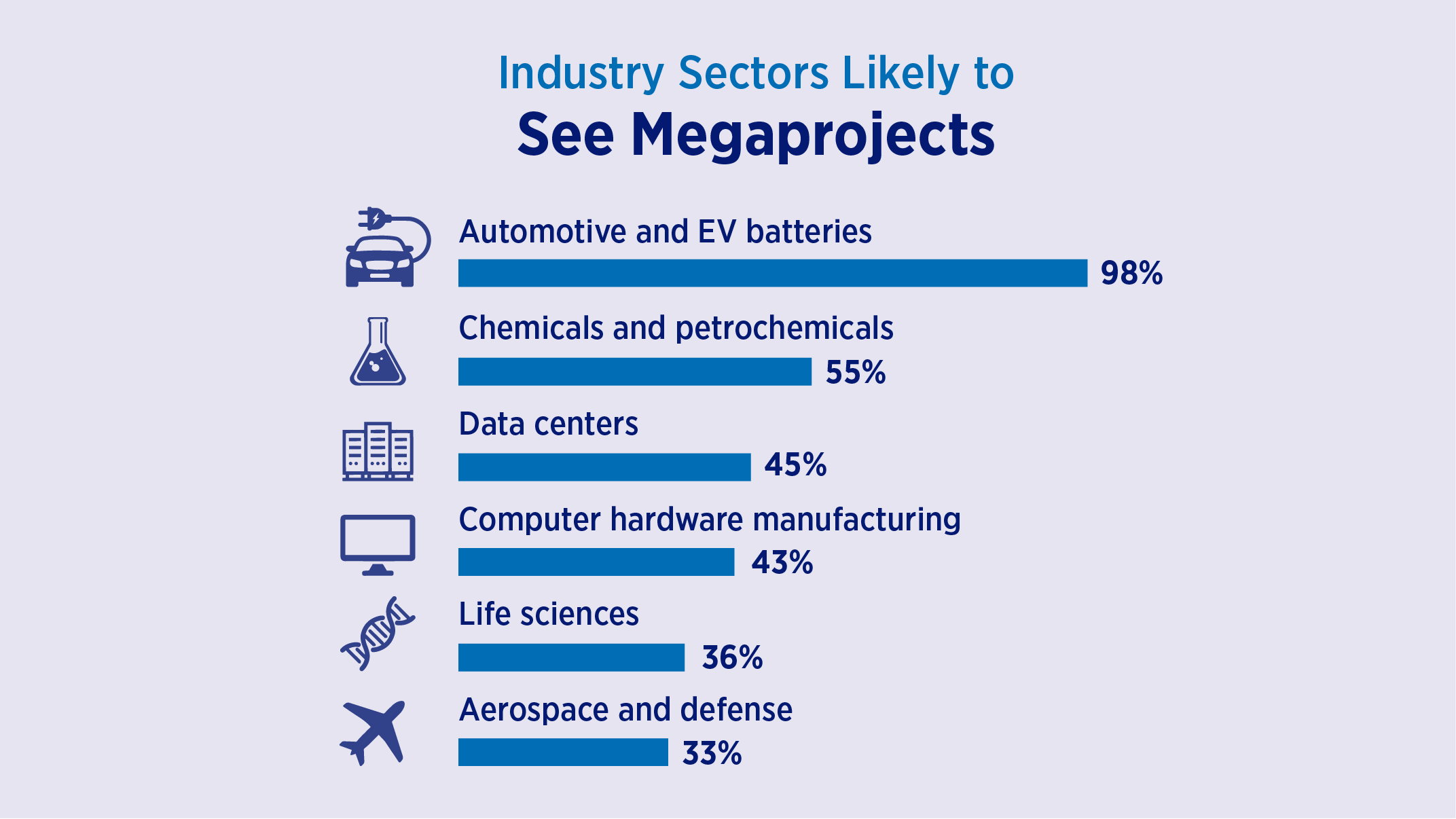

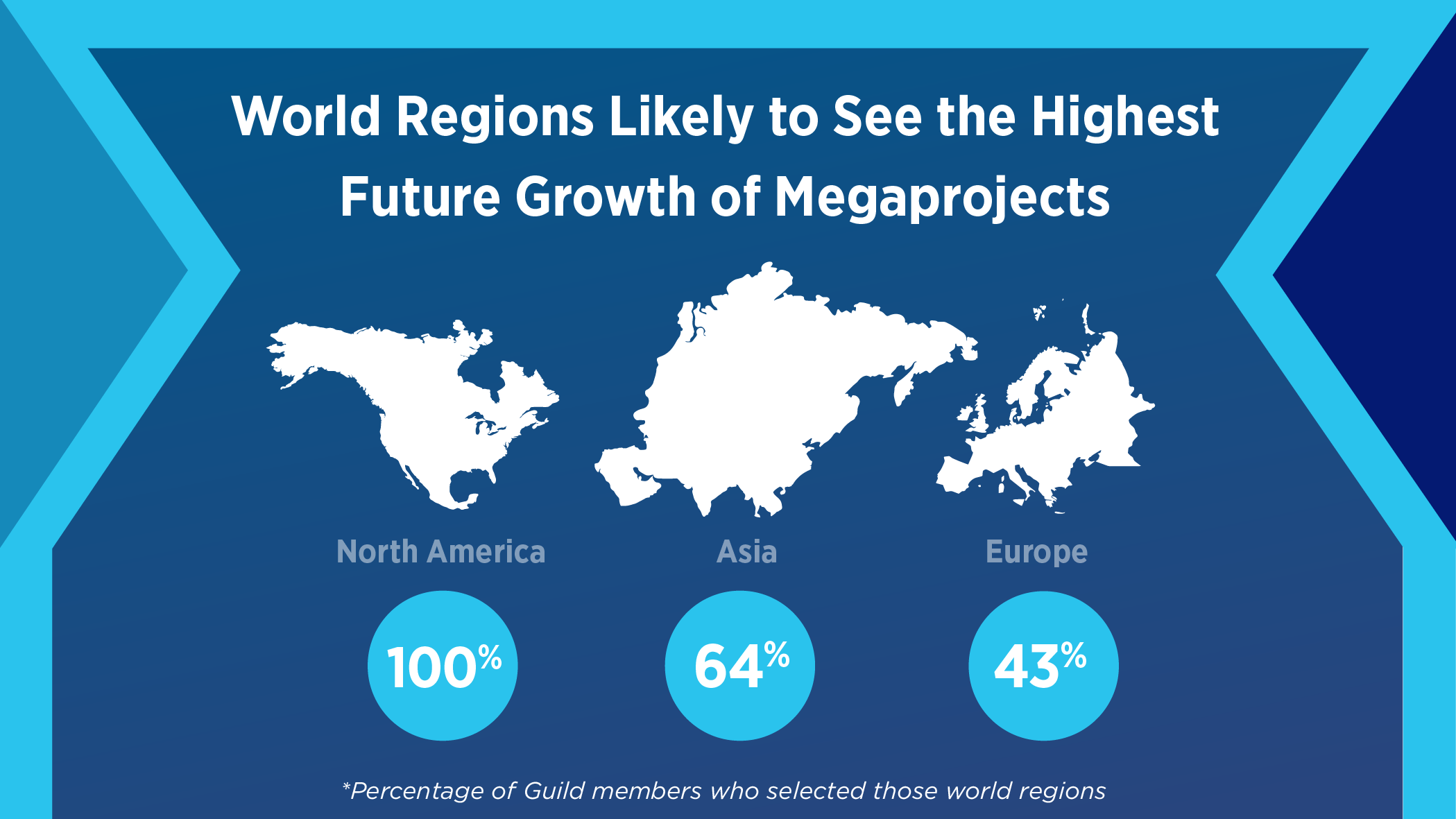

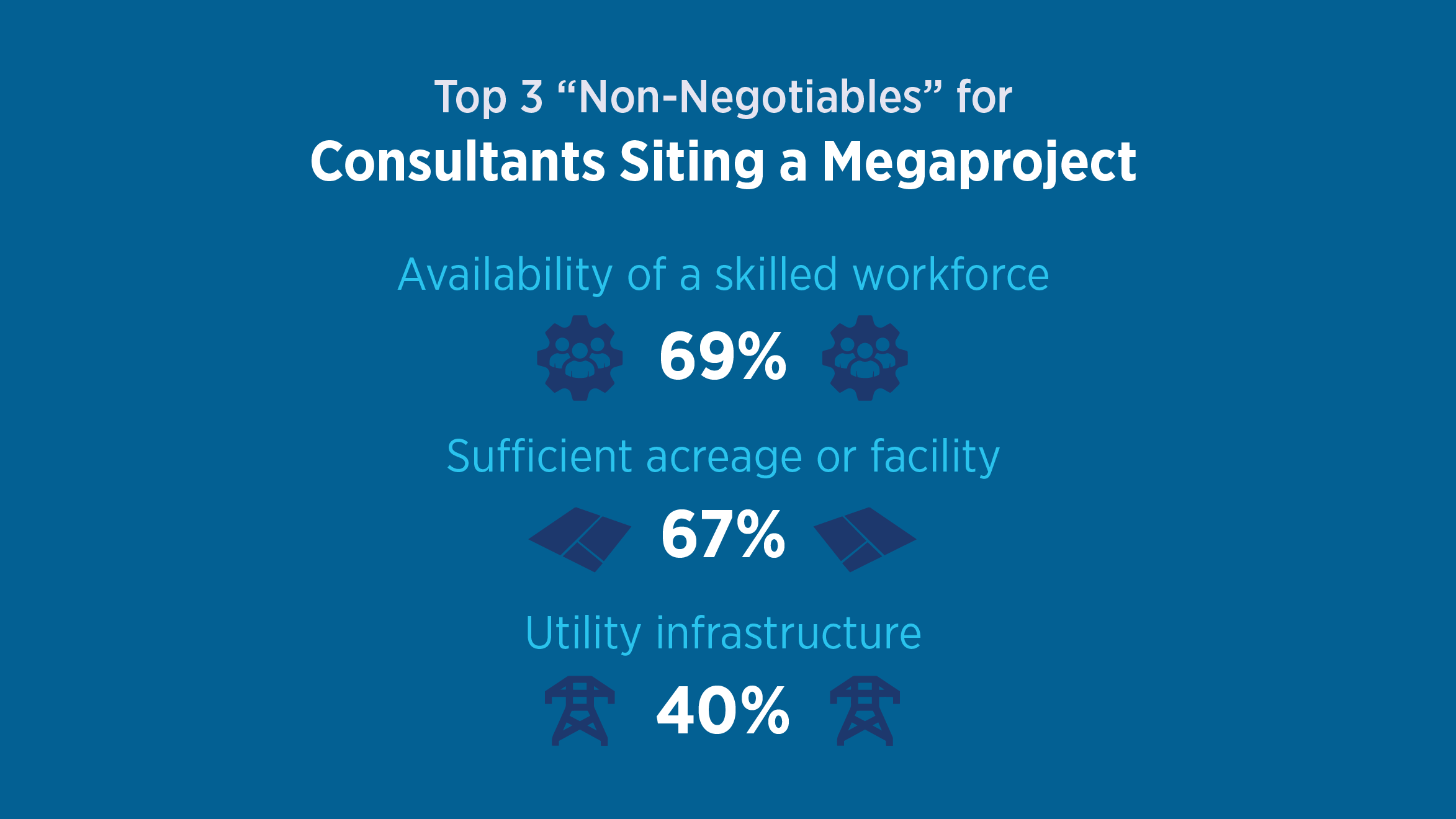

There is strong consensus among Guild members that megaproject investment activity will remain constant or increase in the next five years, North America will see the highest growth in these types of projects and the automotive and electric vehicle (EV) batteries industry will yield more megaprojects than any other industry. The research also highlights the most important factors in megaproject location decisions.

Learn more about the findings of this research conducted in April 2022 below.

Megaprojects have been on the rise in recent years, exemplified by high-profile announcements by Intel in Columbus, Ohio; Tesla in Austin, Texas; Amazon HQ2 in Arlington, Virginia, and many others across the globe.

Megaprojects typically share the following characteristics:

- An investment of more than $1 billion;

- The creation of hundreds to thousands of direct, indirect, and induced jobs;

- Considerable site and/or building requirements – for example, more than a million square feet of facility and/or hundreds of acres of land; and

- Large-scale utility and infrastructure requirements.

While suitable sites, accessible and affordable energy, market size, workforce and incentives all play a role in the predicted dominance of North America in capturing megaprojects, a stable geopolitical environment and reduced supply chain risk are also top considerations. In light of increased political tensions in other world regions, such as the Russian invasion of Ukraine, and ongoing COVID-19 disruptions and restrictions, companies are looking for lower risk environments that will offer a comparatively stable and safe operating environment and minimize production and supply chain disruptions.

For projects of this magnitude and strategic importance, decision-making rises to the highest corporate levels. Nearly 80% of site selectors say the Board of Directors or the Chairman/CEO/President is the ultimate corporate decision maker when it comes to megaprojects.

It can take three to 10 years for states and regions to lay the groundwork to be able to successfully attract a megaproject. Site selectors also emphasized that the long-term impacts of the initial project and also from resulting supplier investments and job creation can be transformative to a region’s economy.

Site Selectors Guild is pleased to announce the launch of REDI Sites Program

- Author: Carrie Kelly

Site Selectors Guild Collaborates with CNBC on Top States for Business Ranking

- Author: NickReshan

Site Selectors Guild Announces Election of Board of Directors

- Author: Rachel Barvi